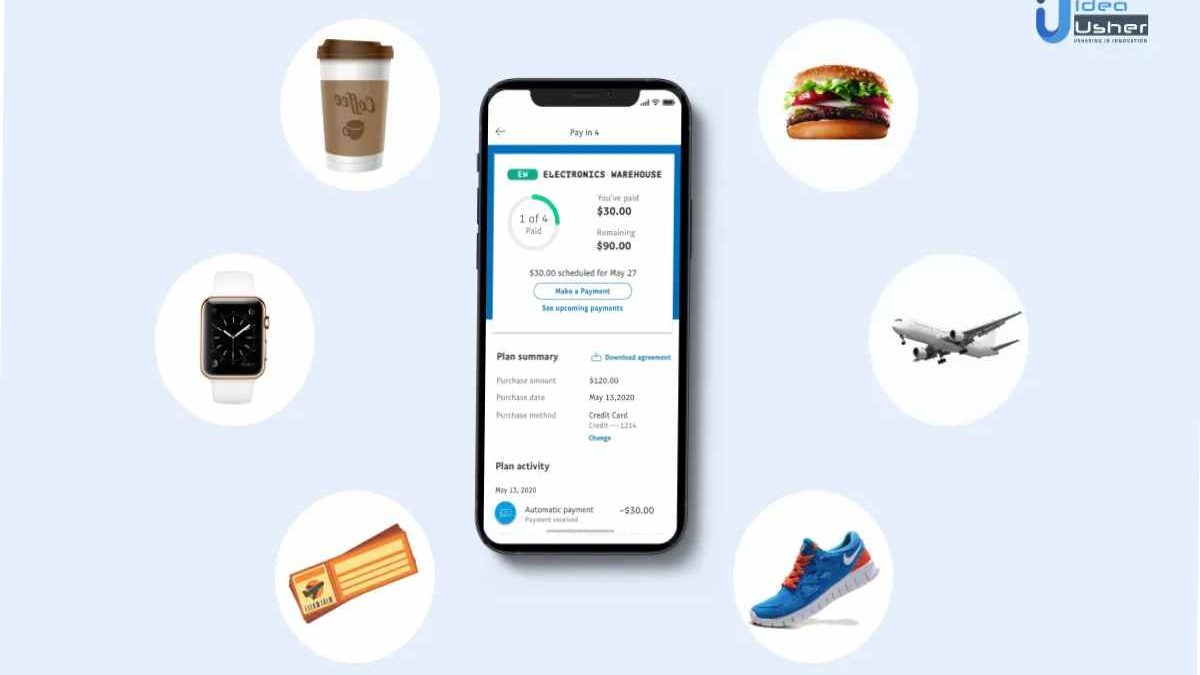

Best BNPL app to pay off your big purchases-Best BNPL app to pay off your big purchases stands for “Buy Now, Pay Later.” (BNPL) is a payment mechanism that enables people to purchase any good today with the understanding that they will pay for it in the future. Businesses utilize it to increase sales by allowing customers to obtain the products they want without worrying about money.

Customers can make payments at their convenience using BNPL. Because Buy now pays later applications don’t charge interest, they also find it simple to use. For businesses, retailers, and merchants, it results in a higher client lifetime value. A penalty for nonpayment, though, may apply.

Table of Contents

Some of the keywords for BNPL are:

- Individuals can make immediate purchases using Buy now, pay later without direct payments. A quick and straightforward setup characterizes this form of the loan arrangement.

- With BNPL, you may make flexible payments at zero interest rates.

- When customers choose to buy now and pay later, some BNPL companies make them exceptional deals.

These businesses charge fees from 2% to 6% that merchants must pay. Ones who offer BNPL services include Sezzle, Afterpay, Paypal Pay, and Amazon Pay.

How Does Buy Now, Pay Later Operate?

Customers who purchase things today can use a credit facility with buy-now, pay-later financing. There is no interest associated with it. It is referred to as a Point of Sale (POS) system by many BNPL businesses since it enables quick product purchases. The technique also significantly increases revenues for the buyers.

Buy now, pay later has a history that goes back to the 19th century. Market vendors brought in fresh goods and merchandise. Customers lacked the finances necessary to purchase them, though. Because of this, shops and merchants in the 1840s permitted customers to buy goods (such as furniture, pianos, and farm machinery) on credit. Customers could acquire goods and make payments later with ease as a result. The public used the term “instalment plan” because of this. Similar to the United States, grocery stores in India used the “buy now, pay later” strategy. By using this strategy, they were able to increase sales.

The term “buy now, pay later” was coined by e-commerce and financial companies at the start of the twenty-first century. They added this function to online stores and e-commerce websites. To entice participation, they introduced numerous incentives and zero interest rates. Additionally, it enabled clients to acquire a credit facility instantly at the POS and pay later. Customers could also book flights using the Buy now, pay later option.

Buy Now, Pay Later Procedure

Utilizing BNPL services is a straightforward and convenient approach. Some examples of BNPL providers include financial technology firms such as Sezzle, Afterpay, Paypal Pay, and Amazon Pay. Loans with and without interest are the two different types of BNPL. The only distinction is that clients frequently charge if they do not pay. The steps to show how BNPL operates are as follows:

- Put whatever you choose into the cart from any shop.

- The Buy now, pay later option is available at the checkout.

- If approved, BNPL applications require the buyer to make a small down payment (often 25%).

- The remaining balance is then due in instalments by the buyer. But there would be no interest added to the transaction.

- Additionally, you may take the amount from the buyer’s bank account, credit card, or debit card.

BNPL versus Credit Cards

While BNPL and credit cards offer credit facilities, there isn’t much of a distinction between the two. The former levies no interest fees latter, however, levies interest. While the former denies doing so, the latter may request a customer’s credit history. Compared to the latter, the former allows clients to pay their debts off without incurring interest for months.

| BNP | Credit Cards |

| No interest rates | Fixed Interest rates |

| No credit history | Good credit history is mandatory |

| Very few fintech companies offer them | Wide acceptance |

| Easier approvals | Slightly difficult |

Best BNPL app to pay off your big purchases Pros And Cons

Significant advantages of BNPL are available to both consumers and enterprises. Given the option of a month or two of credit, customers can use it to make small purchases. However, this method has some shortcomings. Even though the BNPL companies generate a lot of sales, they charge merchants exorbitant fees ranging from 2 to 6%.

Although customers are not required to pay interest, any missed payments will result in late fees. Additionally, this approach encourages customers to make impulsive purchases, which increases debt. For instance, a consumer who purchases gadgets with a buy-now will entice the pay-later option to purchase more things, even though he does not have money.

| Pros | Cons |

| Convenient | Higher merchant fees |

| Fast setup and easy approval | Encourages consumer debt |

| Interest-free terms | Higher spending |

| Exclusive offers | Impulsive towards purchases |

| Increase in credit limit | Attracts penalty on failure |

| Small down payments |

How can businesses that provide “buy now, pay later” profit?

Companies that provide buy now pay later have two ways to make money. First, they assess a transaction fee to the vendors and merchants that ranges from 2 to 8%. Additionally, late fines collected from customers are the second source.

Conclusion:

Over 45% of Americans have signed up BNPL plan, up from 41% in April of last year, according to a recent DebtHammer study. Furthermore, BNPL regards 65% of the respondents as a crucial source of credit financing as a last option. In addition, generation Z and millennials consumed the most BNPL services overall.

According to a different Adobe Analytics survey, many Americans use BNPL apps like Sezzle, Afterpay, Plan It, and PayPal’s Pay to make future payments. When compared to November 2020, BNPL income increased by 422%.