Financer App Crowdfunding- Crowdfunding is a method of online financing in which sponsors promote a certain company concept or initiative to raise money. Not banks or specialist investors, but a wide range of different investors, provide the necessary amount. As a result, many relatively small amounts combine to make up for the desired financing. A “crowdfunding platform” serves as a middleman between people looking for cash and their investors. It unites capital supply and demand and competes with the traditional bank business model. “Stromberg—Der Film,” a film that first appeared doomed to failure due to a lack of funding, is the most recent and well-known example of financing.

- Forms of financing and growth

- Risks and regulation

- Implications for banks

Table of Contents

Forms of financing and growth

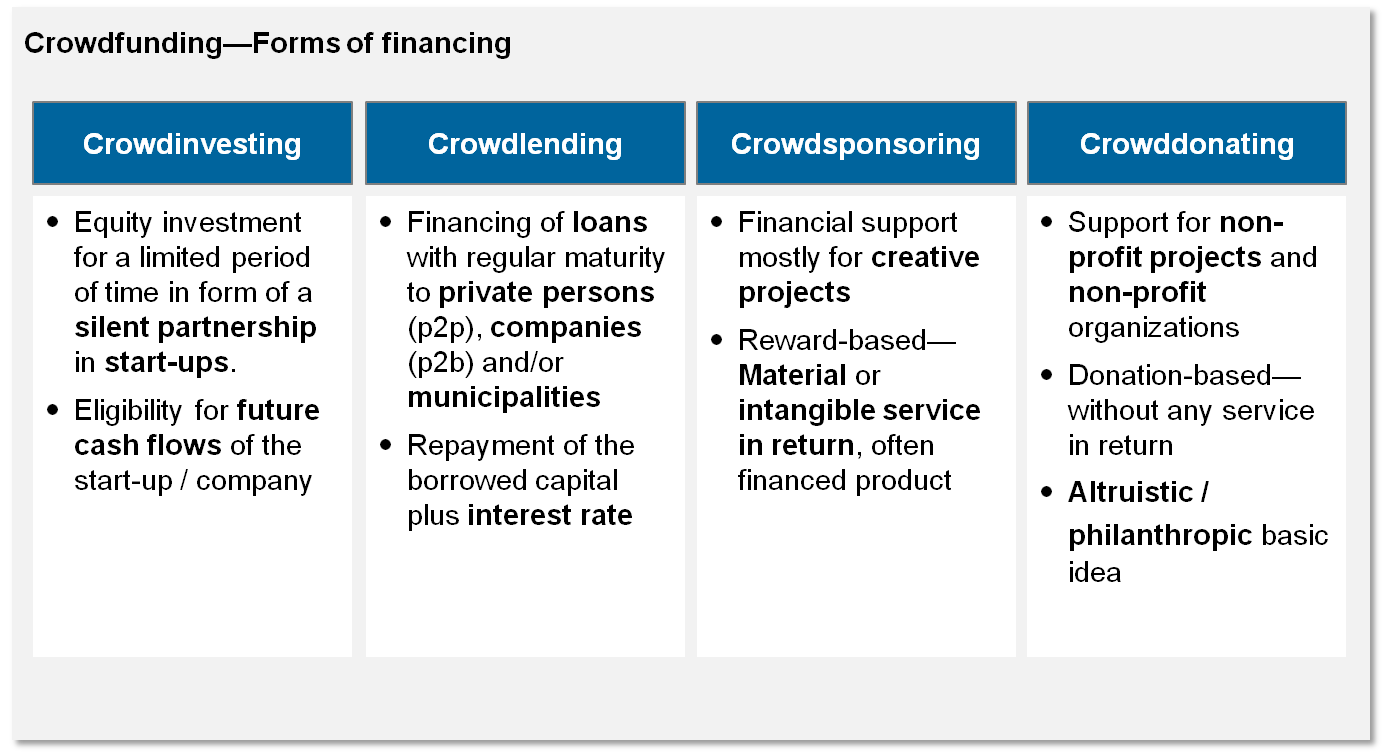

The phrase “crowdfunding” typically refers to four distinct financing methods, each distinguished by the investor’s particular return service—the key distinctions between each strategy showing in Figure 1.

Risks and regulation

The crowdfunding approach has avoided too many rigorous rules, likely due to the reasonable financial amounts. A stricter regulation of business is unlikely when one considers the trends in the USA that have already influenced law. A new law lowered the registration and prospectus requirements, significantly reducing start-up costs, and prompted the regulation of investment restrictions that protect investors. The European Commission announced plans to explore Germany’s crowdfunding potential further.

When one cannot repay high-volume financing on one of the platforms, it will involve many resentful investors. It will be interesting to see how these developments play out. As a result, various federal ministers took action to regulate the so-called “grey capital market” in the wake of the Prokon bankruptcy, for example.

Implications for banks

It has already been demonstrated by some financial institutions how they can use crowdfunding for various business models. For example, crowdfunding is a vital component of the social projects supported through the platform “BW Crowd” of BW Bank, .which is run by a partnership of VR banks. Thus, the business model now even more fully incorporates the notion of regionality. Furthermore, Berliner Volksbank is a platform shareholder, whilst the web 2.0 pioneer Fidor Bank goes further and works directly with some crowdfunding platforms.

Crowdfunding has only funded a few initiatives, which is still manageable. Regarding the small market share, banks do not compel to take action. However, the industry is evolving. Only a few crowdfunding platforms will establish themselves on the market and rise in value; most are still in the identification stage. It is interesting to see how this topic develops over time and the potential challenges financial institutions may face in the medium or long term.

Critical Crowdfunding Applications And Trends:

- Charitable work and nonprofit activities include assisting those who cannot afford to pay for their medical care, carrying out environmental preservation efforts, etc.

- attracting money to companies with the aid of crowdfunding app techniques;

- the introduction of blockchain technology: makes it possible to increase transparency and defend against manipulation in the process of raising and spending funds;

- use crowdfunding platforms to support real estate endeavours. Such initiatives are among the most attractive and dependable investment opportunities during low or negative bank interest rates.

For small and medium businesses, crowdfunding apps provide a viable option for raising money from venture capital firms or angel investors. Sectors like food and drink, medicine, health, and beauty were fundraising leaders in 2019.

Top 10 Benefits Of Financer App Crowdfunding

- It provides access to capital.

- It provides access to capital.

- It serves as a marketing tool.

- It gives proof of concept.

- It allows crowdsourcing of brainstorming.

- It introduces prospective loyal customers.

- It’s easier than traditional applications.

- It’s free PR.

- It provides the opportunity for pre-selling.

- It is free!

Conclusion:

Financer App Crowdfunding in essence, an excellent way for business owners to get money and exposure they require to confirm, and support the expansion of their ventures. Several years ago, what to be a social experiment has proven a helpful tool for thousands of individuals.

Over $1.5 billion has been raised through crowdfunding for enterprises at different stages of development. There is never better moment than now to reap the rewards because the sector is still developing and growing more effectively.

Also read: Finance Education – Intro, F.E with Youth, Literacy and More