What Spread Betting within Finance-Spread betting is a seemingly straightforward piece of vocabulary. While it may seem clear in theory, there may be many practical considerations. Although using this financial trading method without adequate knowledge increases the chance of losing money quickly, it can produce significant gains. In actuality, spread betting frequently results in losses for regular investor accounts.

Table of Contents

What is Financial Spread Betting exactly?

Simply put, trading derivatives through financial spread betting is flexible. In essence, this tactic enables you to speculatively predict whether the value of an investment will increase or decrease.

You don’t have to acquire ownership of the underlying asset when you use spread betting, though. Profits from financial spread betting are often tax and stamp-duty-free as well.

The possibility of making vast sums of money and the absence of taxes that would reduce profit margins may be an appealing approach for investors.

What are Financial Spread Bets?

Spread betting speculates on changes in the price of a security, index, or asset without owning the underlying asset. Then, depending on your wager, you can profit if the market goes toward your position.

Can you profit from financial spread betting?

Spread betting offers the chance to generate a profit if you make a well-informed financial choice. Spread betting makes money when you accurately estimate how an asset’s price will change.

Trading can, however, also result in financial loss if you are not careful. It is why it’s crucial to conduct in-depth research and increase your spread betting knowledge before investing, and never place a wager that could lead to a margin call.

A note on financial spread betting:

- Because they are complicated instruments, spread betting and CFDs might not be appropriate for all investors.

- This post is provided for informative purposes only and does not represent financial advice. All information based on my interpretation of HMRC law is subject to change.

- You might not get back the total amount you invested because the value of your investments (and any income from them) can go up and down. Performance in the past is not a good predictor of future performance. Investments should be thought about over an extended period and fit in with your general risk tolerance and financial situation.

How does spread betting work?

Financial spread betting functions use bets rather than directly purchasing and selling assets. For instance, in a conventional trade, you would buy a share in Company X, keep it while its value increases, and then sell it for a profit.

By betting that the value of the shares of business X will rise, you can earn from spread betting. The more this value shifts in your chosen direction, the more money you can make.

In other words, if you correctly estimate a share’s future path and bet on it, you can profit from both rising and falling markets.

Of course, this works both ways because the more your investment will lose value if the underlying market declines.

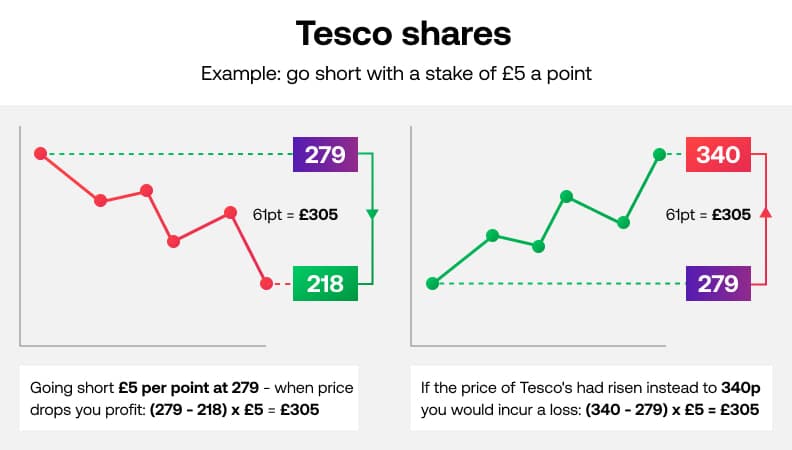

What is a spread betting example?

It may all seem confusing, but as you’ll see with this spread betting example, it’s frequently more straightforward than it looks.

Assume you wish to spread a bet on Company X shares valued at £201.50 each. In this instance, your broker is providing you with quotes for £200 and £203 so that you can take action.

For this spread betting example, let’s also assume that you hit the sell bid at £200 because you believe the stock’s value would decline. Additionally, you opt to spread wager £10 for each point that the stock drops below £200.

You might close your position with a profit of £150 if the stock’s value drops to £185.

(£200-£185= £15) x £10 = £150

What is the difference between spread betting and CFDs?

Typically, many spread betting platforms will also let you trade in CFDs (contracts for difference), which are comparable. These are derivative contracts that allow investors to wager on swift price changes.

CFDs are not actual futures contracts but allow investors to trade the changes in futures prices. Additionally, CFDs trade like any other security and do not have an expiration date or fixed costs.

On the other hand, spread bets have a fixed expiration date from when the change is in the first place. Additionally, commissions and additional fees are frequently higher with CFD trading.

There are some similarities, though. For instance, if you take a long position contract, dividend payouts apply to both spread bets and CFDs. So even though you don’t own the underlying asset, your spread betting provider or organisation will give you profits if the investment performs well.

Such dividend distribution can benefit a spread betting or CFD trading strategy, offering an additional option to profit from your assets.

Of course, it’s essential to remember that any profit you make from trading CFDs is subject to capital gains tax. On the other hand, spread betting profits are tax-free. It’s interesting to note that spread bets and CFD trades are free from Stamp Duty.

How to enter and exit a spread bet?

- You will be able to see two prices posted when you open a spread bet. These are the “sale price” and the “purchase” or “bid” price, respectively. Next, you can choose whether to go long or short by using the purchase or sell price as a guide.

- Click buy if you anticipate a price increase for your selected asset. Instead, click “sell” if you expect a decline in value.

- Simply trading oppositely from when you opened the spread bet is how you close one. As a result, you would have to sell to close a deal if you purchased to join it, and vice versa.

What financial markets can spread bets?

You can use spread betting to predict how many different financial instruments will change in value. Securities, foreign exchange, and commodities may all fall under this category.

It can seem like a reasonably simple strategy since you are essentially betting on whether the market will rise or fall, which attracts many investors. In addition, these investments’ profits must pay without being subject to taxes like capital gains tax. Finally, it makes the ability to profit from both bull and bear markets possible.

Spread betting is a leveraged product, another essential point to remember. It means that you only need to deposit a small portion of the value of the trade, as I mentioned in my previous guide on leverage in trading.

Conclusion:

Financial spread betting may be a profitable endeavour for you, depending on your situation. However, making a knowledgeable choice is crucial because these are highly complex instruments. In any other case, placing spread bets could involve a sizable risk.

Also read: Plan your Finances for New Member Family